Société

CoinStats : Maîtriser les Crypto Swaps pour un bénéfice optimal

21h00 ▪

6

min de lecture ▪ par

Les cryptomonnaies connaissent une popularité croissante. De nombreux facteurs concourent à cette démocratisation, dont le développement d’outils qui facilitent l’accès aux cryptomonnaies, leur gestion et toute transaction afférente aux actifs numériques. Les acteurs du marché offrent également des solutions de plus en plus simples, comme le swap, pour réaliser des profits. Ce processus, de plus en plus populaire auprès des utilisateurs, fait partie des nombreuses fonctionnalités proposées sur CoinStats.

Le swap : de quoi parle-t-on ?

Le bitcoin a ouvert la voie au marché des cryptomonnaies, qui sont désormais acceptées comme moyen de paiement (entre autres avantages). De nouveaux altcoins sont régulièrement introduits dans l’écosystème crypto, offrant aux investisseurs et commerçants davantage de devises à envisager pour leurs transactions. C’est là tout l’intérêt d’avoir recours à des plateformes qui fournissent des services de token swap.

Qu’est-ce que le swap ?

Les premiers investisseurs crypto ont rencontré de nombreux obstacles, notamment des complexités dans la gestion des actifs numériques. Échanger une cryptomonnaie contre une autre sans passer par la conversion crypto-fiat, par exemple, relevait d’un long processus coûteux. Mais les acteurs du marché travaillent systématiquement à atténuer ces difficultés. Ceci, avec l’introduction de plateformes comme CoinStats, qui propose un outil d’échange direct de crypto à crypto, le swap.

Le swap fait référence à l’échange d’une cryptomonnaie détenue par un utilisateur contre la valeur équivalente d’une autre cryptomonnaie. L’utilisateur peut en l’occurrence échanger directement des crypto-actifs contre d’autres sans intermédiaires impliqués dans le processus, comme l’étape fastidieuse de conversion de l’actif en monnaie fiduciaire avant de pouvoir obtenir le token souhaité.

Faciliter l’échange direct crypto-to-crypto et réduire le coût

Avant l’apparition des plateformes de swap, les utilisateurs devaient passer par plusieurs étapes pour négocier un actif particulier, notamment pour les tokens moins connus. Compte tenu du nombre de cryptomonnaies actuellement disponibles, l’appariement recherché est souvent indisponible ou extrêmement rare. L’utilisateur doit alors dans un premier temps convertir ses cryptomonnaies en monnaies fiduciaires, puis acheter l’autre actif souhaité avec ces devises fiats. En cours de route, il paiera à plusieurs reprises des frais de transaction.

Face à ces aléas, l’industrie crypto innove. Ici, l’innovation, qui rime souvent avec simplification, concerne l’apparition de plateformes conçues pour faciliter les échanges instantanés de tokens. En plus de simplifier la transaction, l’idée est aussi de réduire le coût, l’utilisateur ne payant qu’une seule fois les frais de transaction avec le swap.

Ouvrir l’accès à des cryptomonnaies moins connues et en tirer profit

Le swap permet aux utilisateurs d’accéder à des tokens moins connus à des prix avantageux. La stratégie consiste à identifier le token d’un projet à fort potentiel de développement. Au fur et à mesure que ce projet gagne en popularité, son token augmentera en valeur, rapportant ainsi des gains lors de l’échange ou de la vente.

Accéder à des cryptos d’IA

Les cryptos d’IA font partie de ces tokens moins connus, mais prometteurs. Les tokens d’IA sont des actifs numériques utilisés pour les projets crypto basés sur l’IA. Ces pièces permettent d’intégrer l’intelligence artificielle dans divers projets tels que la gestion des actifs, les prévisions de prix, les DAO ou encore la détection des fraudes. Les cryptos d’IA améliorent ainsi l’évolutivité, la sécurité et l’expérience utilisateur dans l’espace crypto.

La popularité de l’IA, notamment avec l’avènement de ChatGPT, a alimenté l’intérêt des utilisateurs pour les tokens d’IA. En février 2023, les chiffres font état de 1,6 milliard de dollars environ pour la valeur marchande de tous les tokens d’IA. Mieux encore, les 30 meilleurs cryptos d’IA étaient toutes dans le vert au cours des 30 derniers jours.

Dans l’état actuel des choses, l’IA devient rapidement un produit révolutionnaire pour les consommateurs et pourrait très bien changer le visage de l’écosystème crypto, dans la même veine que l’ère industrielle et numérique. Raison pour laquelle de plus en plus d’investisseurs misent sur les cryptos d’IA.

Le swapping sur CoinStats

Diversifier son portefeuille fait partie des meilleures stratégies pour prospérer dans le trading et l’investissement crypto, ce qui suppose investir dans plusieurs actifs numériques et utiliser différents exchanges. Cela vient compliquer le suivi des performances dans la mesure où l’utilisateur doit ouvrir plusieurs applications. L’idéal serait d’avoir un tableau synoptique de tous les exchanges sur une seule plateforme.

C’est justement la promesse de CoinStats. La plateforme permet aux utilisateurs de synchroniser tous les portefeuilles et échanges crypto directement sur un seul compte. Cela signifie qu’ils peuvent avoir une vue complète de tous leurs avoirs avec un solde total.

Pour bénéficier de cette fonctionnalité, il suffit de créer un compte sur CoinStats. Suite à quoi, l’utilisateur peut synchroniser tous ses comptes sur la plateforme. Mais il aura aussi accès à de nombreuses autres fonctionnalités, dont le swap. L’option swap fournit aux investisseurs et aux commerçants une passerelle de négociation pratique, dynamique et sécurisée.

Conclusion

Il y aura toujours de nouveaux tokens sur le marché, donnant accès à un large éventail d’opportunités liées au domaine numérique. Cela attire l’attention des commerçants et des investisseurs. Les plateformes comme CoinStats permettent aux utilisateurs d’accéder facilement à ces tokens et projets naissants, de tirer profit du swap stratégique et d’aider la crypto à se développer.

Recevez un condensé de l’actualité dans le monde des cryptomonnaies en vous abonnant à notre nouveau service de quotidienne et hebdomadaire pour ne rien manquer de l’essentiel Cointribune !

Société

Fed Chair Powell says there has been a ‘lack of further progress’ this year on inflation

Federal Reserve Chair Jerome Powell speaks during a press conference following a closed two-day meeting of the Federal Open Market Committee on interest rate policy at the Federal Reserve in Washington, D.C., on Dec. 13, 2023.

Kevin Lamarque | Reuters

Federal Reserve Chair Jerome Powell said the U.S. economy, while otherwise strong, has not seen inflation come back to the central bank’s goal, pointing to the further unlikelihood that interest rate cuts are in the offing anytime soon.

Speaking to a policy forum focused on U.S.-Canada economic relations, Powell said that while inflation continues to make its way lower, it hasn’t moved quickly enough and the current state of policy should remain intact.

“More recent data shows solid growth and continued strength in the labor market, but also a lack of further progress so far this year on returning to our 2% inflation goal,” the Fed chief said during a panel talk.

Echoing recent statements by central bank officials, Powell indicated that the current level of policy likely will stay in place until inflation gets closer to target.

Since July 2023, the Fed has kept its benchmark interest rate in a target range between 5.25%-5.5%, the highest in 23 years. That was the result of 11 consecutive rate hikes that began in March 2022.

“The recent data have clearly not given us greater confidence, and instead indicate that it’s likely to take longer than expected to achieve that confidence,” he said. “That said, we think policy is well positioned to handle the risks that we face.”

Powell added that until inflation shows more progress, “We can maintain the current level of restriction for as long as needed.”

The comments follow inflation data through the first three months of 2023 that has been higher than expected. A consumer price index reading for March, released last week, showed inflation running at a 3.5% annual rate — well off the peak around 9% in mid-2022 but drifting higher since October 2023.

Treasury yields rose as Powell spoke. The benchmark two-year note, which is especially sensitive to Fed rate moves, briefly topped 5%, while the benchmark 10-year yield rose half a percentage point. The S&P 500 fell after being positive earlier in the session, though the Dow Jones Industrial Average held positive.

10-year and 2-year yields

Powell noted that the Fed’s preferred inflation gauge, the personal consumption expenditures price index, in February showed core inflation at 2.8% in February and has been little changed over the past few months.

“We’ve said at the [Federal Open Market Committee] that we’ll need greater confidence that inflation is moving sustainably towards 2% before [it will be] appropriate to ease policy,” he said. “The recent data have clearly not given us greater confidence and instead indicate that it’s likely to take longer than expected to achieve that confidence.”

Financial markets have had to reset their expectations for rate cuts this year. At the start of 2024, traders in the fed funds futures market were pricing in six or seven cuts this year, starting in March. As the data has progressed, the expectations have shifted to one or two cuts, assuming quarter percentage point moves, and not starting until September.

In their most recent update, FOMC officials in March indicated that they see three cuts this year. However, several policymakers in recent days have stressed the data-dependent nature of policy and have not committed to set level of reductions.

Société

Reinke Joins Intact as Chief Underwriting Officer, Transactional Surety

Scott Reinke joined Intact Insurance Specialty Solutions, headquartered in Plymouth, Minnesota, as chief underwriting officer for its transactional surety team. Reinke oversees surety’s commercial transactional book of business and their online surety bond platform.

Reinke has over 20 years of insurance experience. Before joining Intact, he was senior vice president of transactional surety at Arch Insurance Group. Before Arch, he was the director of transactional surety at The Hanover Insurance Group.

Topics

Underwriting

Was this article valuable?

Here are more articles you may enjoy.

Interested in Surety?

Get automatic alerts for this topic.

Related

Société

CRC Moves InsureTrust Cyber Broker to Wholesale Division

Alabama-based CRC Group, a wholesale and specialty distributor and part of Truist Insurance Holdings, has shuffled its deck a bit, moving InsureTrust, a cyber coverage broker, from Starwind Specialty.

Starwind was formed in 2021 with the combination of CRC Group’s Specialty Programs and Constellation Affiliated Partners, according to the company’s website. InsureTrust, headquartered in the Atlanta area, has been around for 26 years and has specialized in cyber insurance.

Now, InsureTrust will be part of CRC’s wholesale brokerage division, CRC said in a news release. The move bolsters CRC’s cyber coverage and expands InsureTrust’s network, the company noted. CRC has offices across the United States, and headquarters in Birmingham, Alabama.

InsureTrust President and CEO Christiaan Durdaller will lead the new cyber practice group.

Topics

Cyber

Agencies

Was this article valuable?

Here are more articles you may enjoy.

Interested in Agencies?

Get automatic alerts for this topic.

Related

Société

Former MLB Player, 3 Others Charged with Staging Auto Accident in Miami

Four people, including a Cuban-born former Major League Baseball player who earned more than $15 million in his playing career, have been charged with staging an auto accident and defrauding an insurance carrier.

Yuniesky Betancourt, 42, who played nine seasons at shortstop for the Seattle Mariners, Kansas City Royals and Milwaukee Brewers, was booked into jail in Miami-Dade County late last week, according to the Florida CFO’s office and local news reports. Three others, Abel Vera, Nancy Mercedes Pena and Maura Perez were also charged with staging the accident in December 2022, then filing a claim with Kemper Insurance.

All four of the alleged perpetrators sought medical treatment and physical therapy for injuries that they never sustained in the crash, CFO Jimmy Patronis said in a statement Monday. The claims totaled $61,000 and Kemper paid out more than $22,800.

Investigators with the Florida Department of Financial Services accessed data from the crashed vehicle’s event data recorder, which showed the accident had not happened as reported, DFS noted.

“Staging accidents is incredibly dangerous and fraud like this costs every Floridian in the form of higher auto insurance premiums,” Patronis said.

Betancourt, who had a .261 career batting average, was paid more than $5 million by each of the three teams he played for, from 2005 through 2013, according to Baseball Reference, an online site. If convicted, Betancourt and his co-defendants could face up to 10 years in prison.

Photo: Betancourt in 2013, hitting something other than a car. (AP Photo/Chris Bernacchi)

Topics

Auto

Interested in Auto?

Get automatic alerts for this topic.

Related

Société

Small Businesses Owners See Stable Business Climate; Cite Cybersecurity as Top Threat

The first quarter Small Business Index, which measures small business owner confidence, is 62.3—similar to last quarter’s score of 61.3—reflecting a stable business climate. More small businesses see an improving economy, which drove the headline score up one point.

One in three (32%) small business owners now say the U.S. economy is in good health, up seven percentage points from last quarter. Roughly two in five (38%) say their local economy is in good health, up eight percentage points from the end of 2023.

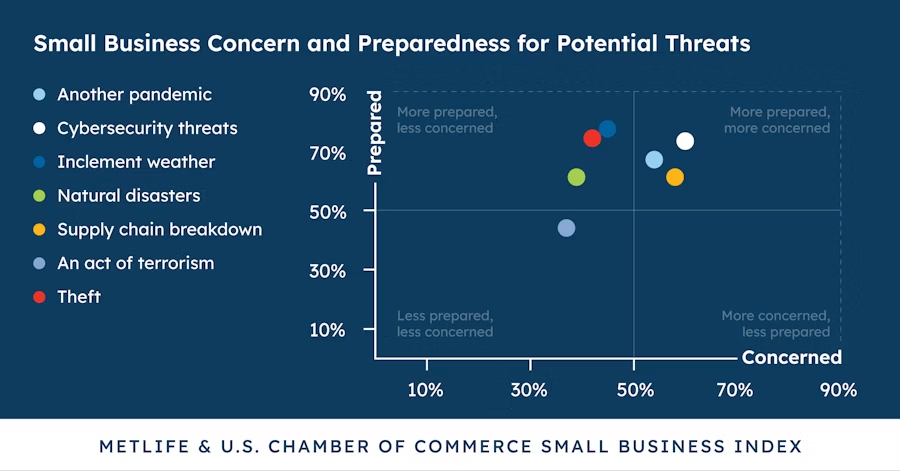

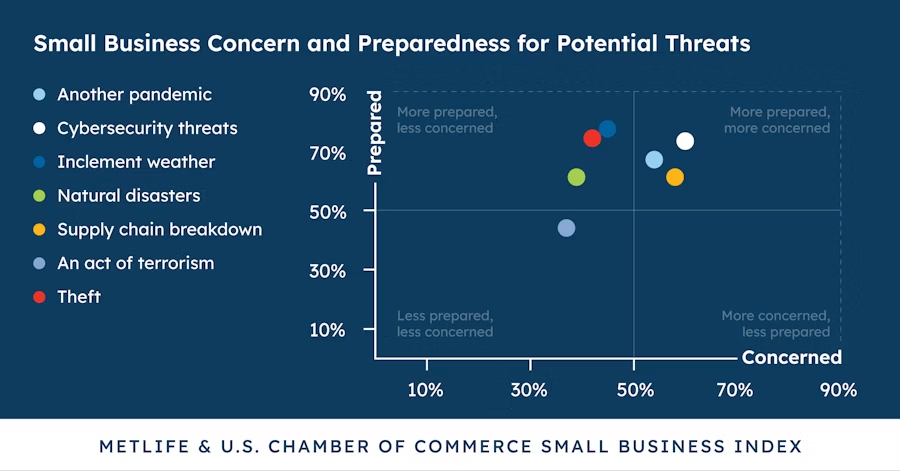

The first quarter survey sponsored by MetLife and the U.S. Chamber of Commerce also found that small businesses see cybersecurity and supply chains as their biggest threats.

“Small businesses’ perceptions of the economy are drifting upward, with businesses reporting being comfortable with their cash flow and the health of their business,” said Tom Sullivan, vice president of Small Business Policy at the U.S. Chamber of Commerce. “While many business owners have continued to struggle with high prices and rising wages, recent jobs reports are positive. While headwinds remain, confidence is ticking upward and small businesses are more resilient and prepared for unforeseen challenges.”

Top Threats

This quarter’s survey asked small businesses about their concern for future threats and their crisis planning in response to those threats. Small businesses say they are most concerned about:

- Cybersecurity – 60%

- Supply chain breakdowns – 58%

- Another pandemic occurring in the future – 54%

- Inclement weather – 45%

- Theft – 42%

- Natural disasters – 39%

- Act of terrorism – 37%

Overall, most (71%) small businesses maintain they are “adequately prepared” for future threats. Most (80%) also say they have a clear idea of how to change their business if it starts to struggle.

Though these topline numbers indicate most small businesses feel prepared to handle what comes their way, across the board, most say they are only somewhat prepared to deal with them, rather than very prepared. For example, 23% say they are very prepared for cybersecurity threats, versus 50% who feel somewhat prepared. The gap is even larger in preparedness for a supply chain breakdown (14% very prepared, 47% somewhat prepared).

To address potential threats, small businesses say they are contributing to rainy-day funds (62%), installing surveillance precautions (56%), training staff on cybersecurity measures (48%), establishing formalized plans for future threats (43%), taking out insurance in case of natural disaster (38%), and building out existing supply chains (35%).

Muted Perception

According to the survey, most small businesses are reporting consistent, high satisfaction with the state of their cash flow and business health. About two-thirds say the overall health of their business is good (65%) and that they are comfortable with their current cash flow (67%).

According to the survey analysis, overall perception of the economy remains “muted” with nearly half of small businesses continuing to feel the economy is in poor health. They remain concerned about inflation with more half (52%) citing inflation as a top challenge. In addition, concern for revenue rose seven percentage points this quarter with 29% saying revenue is a top challenge, returning to a level of concern last recorded in late 2021.

The survey was conducted January 26 – February 12, 2024. The survey has a credibility interval of plus or minus 4.4 percentage points for all respondents.

Topics

Cyber

Commercial Lines

Business Insurance

Société

Beat Capital Partners to Launch Credit Insurance Business, Naming Pike as CEO

Beat Capital Partners, a London-based venture capital investor that focuses on the insurance industry, announced it is planning to launch a specialty and tech-enabled credit non-payment insurance underwriter.

Called “Convergence,” the business is expected to underwrite through a Lloyd’s consortium, led by Beat Syndicate 4242, with Stephen Pike as CEO and founder. Its initial focus will be on Europe and North America.

The date of the launch hasn’t yet been announced.

Convergence will step into the market to meet the growing and largely unaddressed need for portfolio solutions among banks and global financial institutions, specifically targeting the insurance of credit risk portfolios, Beat Capital said.

Convergence plans to leverage a combination of technology and data analytics, powered by a proprietary algorithmic modeling platform developed in partnership with University College London (UCL). This platform enables Convergence to swiftly integrate, enhance, and utilize the extensive data provided by financial institutions. Through this innovative and tech-driven platform, it will offer unparalleled efficiency and precision in servicing a broad spectrum of opportunities in economic risk management.

With 20 years of credit experience, Pike previously held the role of global head of credit and political risk (CPR) at Canopius, having joined the CPR team in 2017. Pike went on to evolve the global reinsurer’s proposition from single situations through the creation of a portfolio credit team.

Prior to that he was co-head of trade finance at ED&F MAN Capital Markets where he established the business’ global trade finance business. He started his career at Merrill Lynch and went on to be a portfolio analyst at Cyrus Capital, a credit special situations fund.

Pike will be joined by Jeremy Hatchuel, co-founder and partner. He brings 10 years of quantitative expertise at the intersection of the capital markets and insurance, starting his career as an ILS structurer at Aon Securities and later joining the Canopius CPR team to lead its portfolio solutions function. Hatchuel has an Master of Science degree in Cognitive Science and conducted research in computational neuroscience at UCL.

“Convergence will be launched to take advantage of the many opportunities available in the CPR market. It is a complex sector and the team has a wealth of experience,” Pike said. “We will be data driven and have developed a proprietary model with UCL which will provide scalable solutions for our clients. Our purpose-built technology, industry knowledge and understanding of individual clients will give us a market leading position.”

About Beat Capital Partners

Beat Capital Partners is a long duration venture capital investor exclusively focused on the insurance industry. Beat provides underwriting teams with equity in their own business, the potential to access to highly rated Lloyd’s (AA-) and other partner paper, a full-service back office, start-up financing, expedient set up and launch plus partnership with Beat’s team and proven record of success. Beat operates 11 underwriting franchises that write US$700 million in gross written premiums in diverse lines of business in the UK, Bermuda and the U.S. Beat also helps manage Syndicates 4242 / 1416 in Lloyd’s and Cadenza Re, a Beat-dedicated reinsurer, in Bermuda.

Source: Beat Capital Partners

Topics

New Markets

Société

Zuckerberg Avoids Personal Liability in Meta Addiction Suits

Mark Zuckerberg won his bid to avoid personal liability in about two dozen lawsuits accusing Meta Platforms Inc. and other social media companies of addicting children to their products.

US District Judge Yvonne Gonzalez Rogers, who is overseeing the cases, sided with the Meta chief executive officer in a ruling issued Monday. The decision dismisses Zuckerberg as an individual defendant without affecting claims against Meta as a company.

Lawsuits filed on behalf of young people have alleged that Zuckerberg was repeatedly warned that Instagram and Facebook weren’t safe for children but ignored the findings and chose not to share them publicly.

Rogers ruled that Zuckerberg was not required to disclose safety information absent a “special relationship” with the users of Meta’s products, according to the order.

The judge also said Zuckerberg couldn’t be held liable just because he’s the public face of Meta. Finding otherwise would create “a duty to disclose for any individual recognizable to the public,” Rogers wrote in the ruling. “The court will not countenance such a novel approach here.”

Rogers said the Meta users and family members who sued can amend and refile their complaints. At a hearing in February, the judge appeared sympathetic to plaintiffs’ arguments that Zuckerberg could be held liable for personally concealing information as a corporate officer at Meta.

A Meta representative and an attorney for the plaintiffs didn’t immediately respond to requests for comment.

The cases naming Zuckerberg are a small subset of a collection of more than 1,000 suits in state and federal courts by families and public school districts against Meta along with Alphabet Inc.’s Google, ByteDance Ltd.’s TikTok, and Snap Inc., owner of the Snapchat platform.

Rogers allowed some claims to proceed against the companies while dismissing others. The companies have denied wrongdoing, saying they have taken steps to keep young users safe on the platforms.

The case is In Re Social Media Adolescent Addiction/Personal Injury Products Liability Litigation, 22-md-03047, US District Court, Northern District of California (Oakland).

Photo: Mark Zuckerberg, chief executive officer of Meta Platforms Inc., during a Senate Judiciary Committee hearing in Washington, DC, US, on Wednesday, Jan. 31, 2024. Congress has increasingly scrutinized social media platforms as growing evidence suggests that excessive use and the proliferation of harmful content may be damaging young people’s mental health. Photographer: Kent Nishimura/Bloomberg

Copyright 2024 Bloomberg.

Topics

Lawsuits

Société

‘Zombie Fires’ Smoldering Near Oil and Gas Wells Threaten Canada’s Drillers

Leftover blazes from last year’s record wildfire season in Canada are threatening to knock out almost 3% of the country’s natural gas production.

A total of 50 so-called zombie fires still smoldering beneath layers of snow are located near oil and gas wells and other production facilities, according to government data analyzed by Bloomberg News. Those sites yield natural gas equivalent to about 80,000 barrels a day of oil in Canada’s energy heartland of Alberta alone, in addition to almost 14,000 barrels a day of crude.

Companies most at risk of disruptions include Tourmaline Oil Corp., the country’s biggest gas driller, as well as oil-sands giant Cenovus Energy Inc. and Paramount Resources Ltd. Smaller explorers could also be affected, including closely held Westbrick Energy Ltd.

Fires From 2023, Smoldering Under Snow, Reveal Canada’s Dangerous New Reality

The residual blazes underscore how Canada’s energy industry — underpinned by an oil-sands sector that produces some of the world’s dirtiest crudes — is increasingly imperiled by climate change. Usually hot, dry weather contributed to the country’s worst-ever wildfire season last year, darkening skies over New York and other US cities. And with over 65% of Canada abnormally parched or in drought at the end of March, the nation is bracing for another smoke-filled summer.

Canada could be facing another catastrophic fire season this year as dangerously dry conditions combine with higher-than-normal temperatures buoyed by the El Niño weather pattern, according to a government forecast. Alberta declared the start of its its wildfire season this year on Feb. 20, the earliest in recent years. Zombie fires, along with new ones, could flare up as temperatures rise throughout the spring.

The leftover fires burn into organic matter in the earth including into peat, which smolders easily and is difficult to extinguish. The blazes from 2023 aren’t generally as much of a threat as new conflagrations that emerge, but the large number of carryover fires this year is a problem, Alberta Wildfire spokeswoman Josee St-Onge said by phone.

“The advantage is we know them and we have been working on them for a year,” she said, cautioning that the province is entering a period when blazes flare up.

A representative for Cenovus said the company is building on what it learned last year to prepare for wildfires this season, including updating its fire program and completing risk assessments to ensure areas with excess vegetation are identified and mitigated. Spokespeople for Tourmaline and Paramount didn’t immediately respond to requests for comment.

For Westbrick, which shut in as much as 30,000 barrels of oil equivalent last year, the leftover fires are not a reason to be “overly concerned,” Chief Executive Officer Ken McCagherty said by phone. Much of the vegetation that fueled last year’s wildfires has been burned off, he said.

“We’re in a far, far better position this year than last year,” McCagherty said.

Chevron Corp., Canadian Natural Resources Ltd. and Baytex Energy Corp. at times shut production equivalent to about 300,000 barrels of oil a day combined last year as blazes encroached on wells and processing infrastructure, mostly in the western shale oil and gas producing regions along the British Columbia and Alberta border. The fires scorched about 4% of the country’s forests.

That damage was dwarfed by the fire season of 2016, when more than 1 million barrels of daily oil output was shut during a devastating blaze that razed sections of Fort McMurray — the largest city near most producers’ oil-sands operations — and caused about C$3.7 billion in insured losses, making it Canada’s costliest natural disaster.

Top photograph: An oil refinery north of Fort McMurray, Alberta, Canada, in 2016. Photo credit: Darryl Dyck/Bloomberg

Related:

Copyright 2024 Bloomberg.

Topics

Energy

Oil Gas

Canada

Société

Why a $100,000 salary no longer buys the American Dream in most places

The American Dream — which for many people involves some combination of owning a home, getting married, having kids and making enough after expenses to save for retirement and spend on leisure — is becoming increasingly expensive.

“The benchmark of a six-figure salary used to be the gold standard income,” Sabrina Romanoff, a clinical psychologist, told CNBC. “It represented the tipping point of finally earning a disposable income and building savings and spending based on your wants, not just your needs.”

More than half (52%) of Americans say they would need at least $100,000 a year to feel financially comfortable, with 26% saying they would need a salary in the range of $100,000 to $149,000 per year, according to a 2023 CNBC Your Money survey conducted by SurveyMonkey.

“Unfortunately, what has happened is that wages haven’t kept up with the cost of living, by and large, for the last 50 years or so,” said Elise Gould, senior economist at Economic Policy Institute.

“It becomes increasingly hard for many families to be able to attain that sort of middle-class lifestyle, that American Dream,” Gould said.

Consumers using the popular 50-30-20 budget guideline aim to spend 50% of their income on essential expenses, with another 30% for discretionary spending and the remaining 20% for savings.

A new report from GOBankingRates used that framework to analyze how much money a family of two adults and two children would need in each state to own a home, a car and a pet. The report tallied estimated annual essential expenses for such a family and then doubled that figure.

Using that framework, GoBankingRates found that all 50 states require more than a $100,000 annual income, according to the report, with 38 states needing more than $140,000.

Economists have suggested that debt growth has become a substitution for income growth. Student loan debt reached an all-time high of $1.77 trillion in the first quarter of 2023 and Americans collectively owe $1.13 trillion on their credit cards as of the fourth quarter of 2023. This debt can have a ripple effect, especially when entire generations are starting their adulthoods with thousands of dollars in debt.

“Now people making well over six figures are still living paycheck to paycheck,” Romanoff said. “So what used to symbolize financial freedom is now keeping people stressed about making ends meet.”

Watch the video above to learn how much families in the U.S. need to make to achieve the American Dream.

Société

Australia’s Weather Bureau Says El Niño Has Ended, Unsure About La Niña Formation

An El Niño weather event has ended, Australian weather authorities said on Tuesday, adding that they were uncertain if a La Niña phenomenon would form later this year, as other forecasters have predicted.

The cycle between the two is hugely important for farmers worldwide. El Niño generally brings hotter, drier weather to eastern Australia and Southeast Asia and wetter conditions to the Americas, while a La Niña has the opposite effect.

“El Niño has ended,” Australia’s Bureau of Meteorology said, after the weather phenomenon had formed in the middle of last year following three years of La Niña.

Warmer sea surface temperatures in the central and eastern tropical Pacific cause El Niño and cooler temperatures lead to La Niña, which a U.S. government weather forecaster this month gave a 60% chance of emerging in the second half of 2024.

The sea surface has been cooling since December and oceanic and atmospheric indicators now show the El Niño–Southern Oscillation has returned to neutral, the Australian weather bureau added.

“Climate models indicate ENSO will likely continue to be neutral until at least July 2024,” it said, using the formal name, the El Niño Southern Oscillation, that describes the switch between the two phases.

While some climate models predict a flip to La Niña later this year, the bureau said it was uncertain whether this would happen and urged caution about such forecasts.

(Reporting by Peter Hobson; editing by Clarence Fernandez)

Topics

Australia

Was this article valuable?

Here are more articles you may enjoy.

The most important insurance news,in your inbox every business day.

Get the insurance industry’s trusted newsletter

Related

-

Lifestyle10 months ago

Lifestyle10 months agoLes erreurs courantes à éviter lors de l’utilisation d’un thermomètre de piscine

-

International11 months ago

International11 months agoJeff Bezos and Lauren Sanchez are seen boarding his $500 MILLION superyacht

-

Divertissements10 months ago

Divertissements10 months agoAmphinobi – Pokémon Écarlate / Violet

-

France4 months ago

France4 months ago“Mon beau Noël blanc…” : pourquoi la neige est-elle de plus en plus rare pour Noël ? : Femme Actuelle Le MAG

-

Sports12 months ago

Sports12 months agoLionel Messi écope de 2 semaines de suspension

-

International11 months ago

International11 months agoDes images choquantes montrent le moment où la police rencontrée tire et tue deux chiens après qu’une femme a été mutilée lors d’une attaque

-

International11 months ago

International11 months agoUn sans-abri dit que Met a “assassiné” ses chiens Millions et Marshall

-

Afrique11 months ago

Afrique11 months agoLegault envisage d’imposer des exigences linguistiques en français aux immigrants temporaires

-

Afrique11 months ago

Afrique11 months agoAu Canada, les étudiants africains francophones discriminés

-

Divertissements10 months ago

Divertissements10 months agoСémаntіх du 19 juіn 2023 aide et solution du jour .